Why Was My Workers’ Comp Claim Denied?

April 12, 2022

How to Find a Wrongful Death Attorney

April 30, 2022Verdicts & Settlements: Jury Sides with Homeowner, Awards Full Damages After 20 Minutes of Deliberations

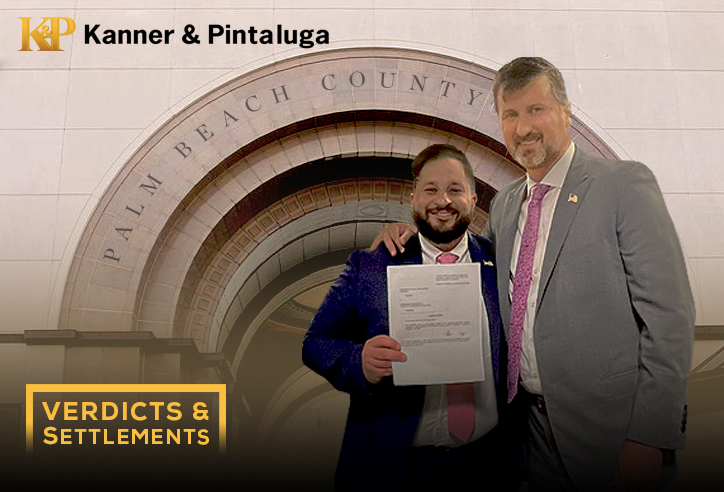

Boca Raton, FL – Yesterday, a Palm Beach County Jury sided with our clients and awarded from their insurance company, Universal Property & Casualty Insurance (“Universal”), the full amount they spent to repair their home.

In 2020, our clients submitted a claim for a roof leak that was discovered when their grandson was checking in on them. Universal agreed to cover the interior damages but wholly denied coverage for the roof for wear and tear and deterioration forcing our elderly clients to pay out of pocket for a new roof to protect their property from further damage. Left with no other option, Kanner & Pintaluga’s Property Damage Team filed suit on their behalf to recoup the cost of the roof. After suit was filed, Universal asserted additional defenses alleging that our clients did not submit a “timely” sworn proof of loss despite the fact their denial of coverage occurred prior to the sworn proof of loss being due.

After a year of litigation with the insurance company, Kanner & Pintaluga attorneys Jeff Groover and Ardalan Montazer tried the case before a six-member jury. Following a three-day trial, the jury returned a verdict in about 20 minutes finding the loss occurred during the policy period, found against the insurance company on all of its defenses, and awarded our clients the full amount of damages sought.

“There has been a lot of buzz lately by insurance companies that fraudulent property claims are the root cause for property insurance rate increases in Florida,” said Kanner & Pintaluga Attorney, Ardalan Montazer.” This case goes against that narrative and is a perfect example of an insurance company that denied a legitimate claim and then over litigated it costing them thousands more in legal costs.”

This verdict comes on the heels of Gov. DeSantis calling for a May 2022 Florida Legislative Special Session to address the state’s property insurance system which has recently led to huge rate increases and loss of coverage for some homeowners. Legislators were unable to pass any reform efforts on the issue during their regular session earlier this year. For example, the Florida Senate proposed allowing new deductibles of up to 2% on roof damage claims due to complaints by insurers that questionable, if not fraudulent, roof claims are driving up costs. But the House rejected the idea, which would have led to increased out-of-pocket costs for homeowners who need to replace damaged roofs. Critics of the reform, including homeowners who have suffered legitimate losses, assert that many of the insurance companies are looking only at their bottom line and lining the pockets of their executives by denying perfectly legitimate claims. When homeowners fight back and the insurance companies are faced with extra legal costs incurred by poor risk management, they unfairly pass the costs on to policyholders through rate increases.

The case is Edward Navlen and Saunee Navlen v. Universal Property & Casualty Insurance Company, Case No.: 502021CA003962XXXXMB in the Circuit Court of the 15th Judicial Circuit, Palm Beach County, Florida.

Get What you Deserve

Kanner & Pintaluga is an aggressive, ethical, and results-driven national plaintiff firm committed to representing accident, serious injury, and property damage victims. With a team of nearly 100 attorneys, we have the experience and expertise to achieve the most favorable outcome for our clients. If we can assist you or if you’d simply like to speak to an attorney about getting the help you need, please do not hesitate to contact us. Our team is always available to discuss your rights and make certain that you and your family are protected.