- WE’RE HERE TO HELP 24/7

- 800.586.5555

Why Don’t Insurance Companies Offer Flood Insurance?

When is the Right Time to Call a Lawyer for Your Hurricane Damage Claim

August 15, 2019

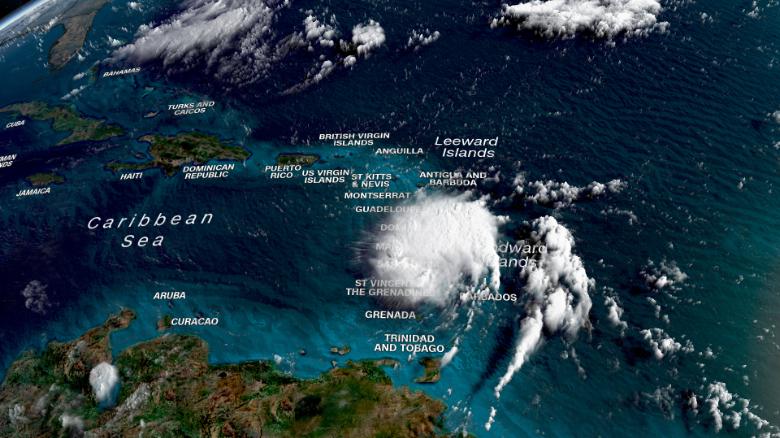

Hurricane Dorian Is Forecast to Reach Category 4 Before Making Landfall on Florida’s East Coast

August 27, 2019Why Don’t Insurance Companies Offer Flood Insurance?

To put it simply, insurance companies don’t provide flood insurance for homes because when floods do strike, the amount they have to pay out in claims settlements is far greater than the amount they take in through premium payments. This essentially means that offering flood coverage puts the profitability of home and business insurance at risk.

This left a lot of people in flood-prone areas out of luck when severe flooding damaged or destroyed their homes. In 1968, congress finally stepped in with the creation of the National Flood Insurance Program (NFIP). Communities in high-risk flood zones, like many in Florida, were offered NFIP flood coverage.

NFIP stopped breaking even after Hurricane Katrina, and as of 2017, in the wake of Hurricane Sandy, the NFIP was more than $25 billion in debt. As of 2017, there were more than 5 million NFIP policies in effect, and the average flood claim settlement was $91,735.

Just for comparison, the average homeowners insurance claim in 2013 was $8,787. At the time, the most common homeowners claim was wind damage, followed by non-weather-related water damage (like burst pipes), then hail, weather-related damage and theft.

NFIP Claim Payments and Institutional Stability

NFIP paid out approximately $17 billion in flood claims for Hurricane Katrina, and nearly $8.4 billion after Hurricane Sandy in 2012. Hurricane Harvey was the NFIP’s second most expensive hurricane at nearly $8.8 billion.

Based on the pretty dramatic difference between the average homeowners claim ($8,787) and the average flood-damage claim during a big hurricane year ($91,735), it’s pretty clear why the insurance companies have no desire to offer naturally occurring flood damage insurance.

As of today, the NFIP must borrow money from the U.S. Treasury to pay out flood claims. In September 2018, the program’s debt was down to $20.5 billion, but that reduction was only thanks to the cancellation of $16 billion of the programs debt by the U.S. Congress in October 2017. This debt-relief was part of a special hurricane relief bill that also provided $4.9 billion of low-interest loans to Puerto Rico to help the territory rebuild following Hurricane Maria.

This legislation was particularly important for the NFIP, because the program had reached its $30.4 billion borrowing cap in the wake of Hurricane Harvey. The NFIP cannot legally exceed this debt limit, meaning after Hurricane Harvey they were potentially in a situation where they could no longer honor flood damage claims.

The NFIP’s borrowing authority has been increased several times since the program’s founding:

- Back in 1968, the program could only borrow up to $250 million

- That limit was raised to $500 million in 1973 (or up to $1 billion with presidential approval)

- It was raised again in 1996 to $1.5 billion

- Hurricanes Katrina, Rita and William taxed the system, leading Congress to raise NFIP’s borrowing limit to $18.5 billion in 2005

- The next year, they increased the programs borrowing limit again to $20.725

- In the wake of Hurricane Sandy in 2013, the limit was increased to $30.425 billion

Do People Know They Have to Get a Separate NFIP Policy for Natural Flooding?

The good news is the majority of homeowners, at least two thirds of them according to a 2018 Insurnace.com survey, understand that homeowners insurance doesn’t cover flood damage. Eighty percent of policy holders in the 45 to 64-year-old demographic understand that they need a separate policy, but the overall ratio was brought down by 25 to 34-year olds, of which only half knew that a separate policy was needed.

An important note on NFIP flood insurance – you have to live in an approved community to even qualify to enroll in the NFIP flood insurance plan. You can find a list of communities eligible for flood insurance broken out by state here.

Eligibility is surprisingly flexible. Even places where people are at a very low risk for flooding are likely eligible to sign up for NFIP. As FEMA says, homeowners, renters and business owners “are eligible and encouraged to purchase National Flood Insurance Program (NFIP) policies even if their home or business isn’t located in a flood plain or high-risk zone.”

How Much Does NFIP Flood Insurance Cost?

Considering the cost of the average flood claim during active hurricane and flood years, NFIP premiums are surprisingly affordable. Although there was an eight percent increase in 2018, the estimated average, including fees and surcharges, is just $1,062 a year.

Will that eight percent increase be enough to get NFIP above water? Unlikely, considering the program’s more than $20 billion deficit.

Should You Enroll in NFIP?

If you’re living in Florida and you’re anywhere in the vicinity of the shore or a river, you should definitely consider purchasing flood insurance if you haven’t already. Property damage attorneys and independent claims adjusters fight hard to help home and business owners receive compensation for hurricane-related damages in the wake of storms, but those policies are pretty clear when it comes to naturally occurring flood damages – they aren’t covered.

However, if your home has suffered hurricane damage that was unrelated to flood waters, such as hurricane wind damage, your insurance company should pay out your claim. If your insurance company ever tries to lowball your claim or say that the damage shouldn’t be covered, it may be in your best interest to speak with an independent insurance claims adjuster or a hurricane property damage attorney.