- WE’RE HERE TO HELP 24/7

- 800.586.5555

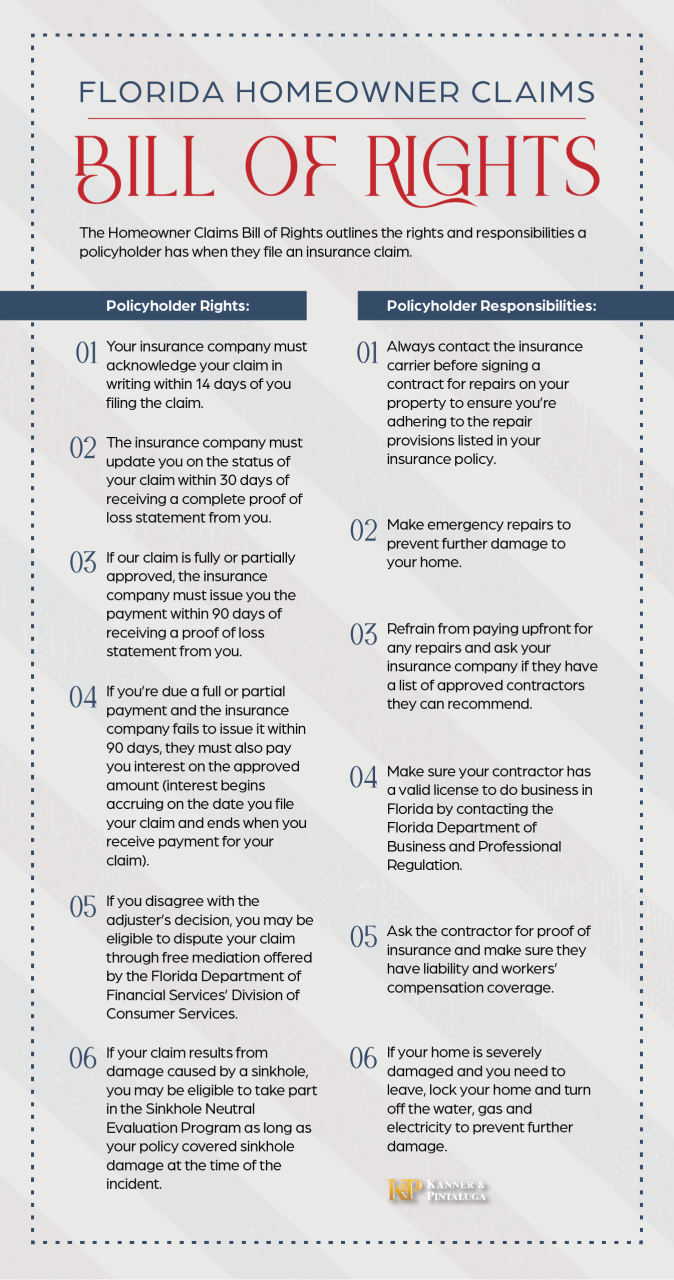

Florida Homeowner Claims Bill of Rights

Verdicts & Settlements: $300,000 Settlement Reached in Negligent Inspection Case

August 29, 2022

Verdicts & Settlements: Nearly $500,000 Recovered in Trip & Fall Case

September 8, 2022Florida Homeowner Claims Bill of Rights

Insurance companies are obligated to send Florida homeowners the state’s “Claims Bill of Rights” when they file a property damage claim. This must be sent to you within 14 days of receiving your claim.

The purpose behind this document is to make you aware of the rights and responsibilities you have as a policyholder when you file a homeowners insurance claim.

Unfortunately, many legal documents use jargon and impersonal and convoluted language, which may make them difficult to understand.

We’ve attempted to simplify the claims bill of rights in a straightforward and reader-friendly way. In the wake of Hurricane Ian, it’s of the utmost importance than Florida homeowners understand their rights when filing property damage claims.

Your Rights

-

Acknowledgment of Your Claim

After you submit your insurance claim, your insurance carrier has 14 days to let you know they’ve received your claim. The law doesn’t specify how this acknowledgment should be communicated, meaning you can receive your claims bill of rights digitally or via mail.

-

Claim Update Within 30 Days

Under Florida law, insurance agencies have 30 days to decide how to handle your claim. However, to make a decision, they need a document called a proof-of-loss statement. You are responsible for filling out this document, which should contain the following information:

- Date and time of the incident

- Type of incident, such as theft, fire, flooding, etc.

- List of things that were damaged, such as parts of your home and personal possessions

- Type of damage, such as smoke, water damage and whether the property and items are reparable or need to be replaced

- Evidence of the losses, such as pictures, videos and a police report

- Replacement value of your property in case items need to be replaced

- Parties who have a financial interest in your property, such as you and your mortgage lender

Once the insurance company receives a complete proof-of-loss statement, they have 30 days to determine whether your claim is:

- 100 percent covered

- Partially covered

- Denied

- Still being investigated

-

Payment Within 90 Days

Florida law dictates insurance companies have 90 days to issue payment after receiving a proof-of-loss statement from the claimant.

Within those 90 days, you have the right to receive:

- Full payment for your claim

- A partial payment (insurance may agree to only cover some of your losses)

- A denial of the claim (if your losses weren’t covered by your policy)

-

Interest on Overdue Payment

If you were supposed to receive full or partial payment for your claim but didn’t receive the money within 90 days of filing your claim, the insurance company must pay you interest on the approved payout. Interest begins accruing on the date you file your claim and ends when you receive payment for your claim. The interest payment is due on the same day your claim is paid.

-

Free Mediation

If you wish to dispute your claim, meaning you and your insurance company cannot come to an agreement on whether you should receive payment, you may be able to participate in free mediation to resolve the dispute.

To see if you’re eligible for free mediation, contact the Florida Department of Financial Services’ Division of Consumer Services.

You can also consult with a third-party for assistance, such as a property damage attorney or a public adjuster.

-

Neutral Investigation

People with claims for damage caused by sinkholes may be eligible to take part in the Sinkhole Neutral Evaluation Program, as long as your policy covers sinkhole damage. The program is administered by DFS’ Division of Consumer Services and provides an unbiased expert evaluation of your property to determine if the damage is from sinkhole activity.

Your Responsibilities

-

Communicating Repairs

You should file your claim directly with your insurance carrier and contact them before signing a contract for any repairs on your home. Your insurance company may work with certain remediation or repair companies. They will also only want to pay for work performed by properly licensed and insured contractors.

-

Prevent Further Damage

To prevent further damage, make necessary emergency repairs. For example, if your roof is damaged and leaking water, you may need to purchase a tarp and place it over the roof damage. If you make emergency repairs to your home, make sure to keep the damaged property (if possible) and receipts for repair supplies. Don’t forget to take pictures of the damage before and after the repairs are made.

-

Carefully Read Repair Contracts

Carefully read and question contracts that require you to pay upfront or pay a portion of your insurance settlement for repairing your property.

A legitimate business should have policies on how to handle repairs that will be covered by your insurance. Ask your insurance company if they have a list of approved contractors they recommend instead of hiring someone with questionable practices.

-

Check Your Contractor’s License

Florida law requires you to verify the contractor you’re about to employ is licensed to do business in the state. You can find this out by calling the Florida Department of Business and Professional Regulation at 850-487-1395 or by visiting their website.

You should also learn if the contractor has any complaints against them and if they can provide you with references from their previous customers.

-

Ask Contractor for Proof of Insurance

Before they begin any repairs, ask your contractor for a certificate of insurance. Make sure the insurance policy is active and includes:

- Liability insurance in case something goes wrong while they’re working on your property

- Workers compensation for their employees

-

Secure Your Home Before Leaving

If the damage to your property is severe and you need to stay somewhere else while repairs are underway, make sure to properly secure you home by locking it and turning off water, gas and electricity.

Securing your home is important to prevent further damage from occurring.

Do You Need Legal Assistance with Your Florida Homeowners Insurance Claim?

Has your claim been undervalued or denied by your insurance company? Dealing with rigid insurance adjusters and intricate insurance laws can be difficult.

If you believe you’re being treated unfairly by your insurance carrier, consider contacting an experienced property damage attorney who can help you maximize your claim.